Growth financing

With regard to such activities, we prepare a joint analysis of the financing needs of your company with our investors and you.

ALLFINCON

GROWTH FINANCING

Growth shows more and more facets in times of supply chain problems, e.g.:

1.

Development of new supply sources / transport routes

2.

Securing supply chains

3.

Insourcing of sub-processes

4.

Participation in companies

5.

Optimization / expansion of the warehouse

6.

Addition / expansion of the machine park

7.

Restructuring Purchasing / Sales

With regard to such activities, we prepare a joint analysis of the financing needs of your company with our investors and you. This is the basis for a company-specific financing solution to support the qualitative and quantitative growth of your company.

In doing so, we not only integrate the alternative capital market products that are suitable for you into your corporate financing, but also restructure existing liabilities on request.

As start-ups, companies usually rely on venture capital, support programmes or shareholder funds. At a certain point, however, a certain size and position on the market are achieved. Then the available funds will no longer suffice. In addition, the existing shareholders usually do not want to raise any further equity, because this would be associated with the sale of additional shares and thus influence on the company’s development. Accordingly, debt capital is to be acquired. Due to the usually short company history and the predominantly not yet profitable operating business, it is difficult for companies to obtain classic bank financing. This is where growth financing comes in.

ALLFINCON

Growth process

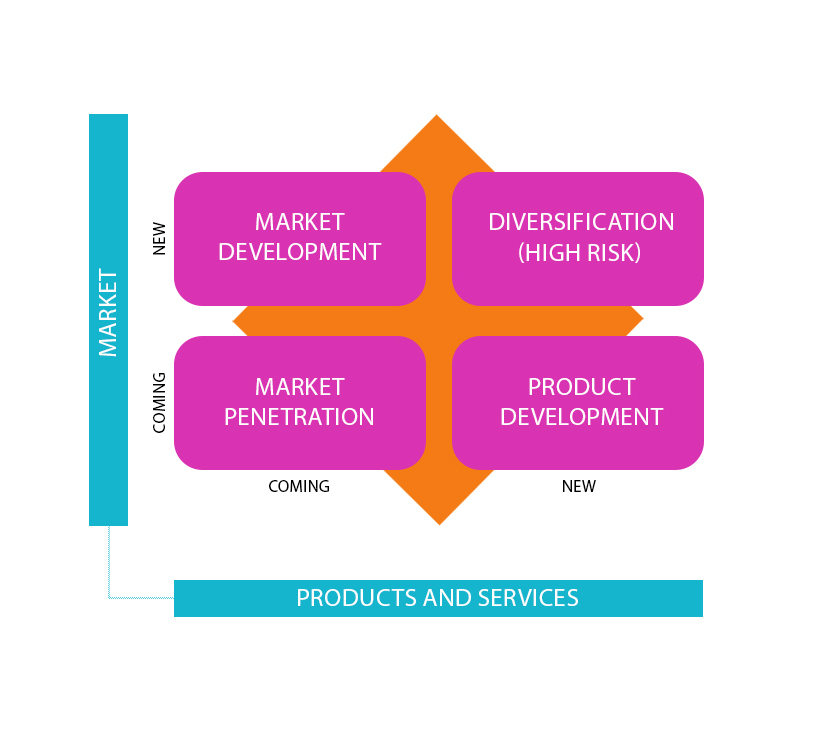

There are different reasons why you need additional capital to realize growth processes. A role is played by which growth strategy you choose. The product-market matrix describes four combinations of product/services and markets:

Market penetration

Product development

Discounts cover the costs

Drawdown limit in line with current inventory value

Hassle-free change of bank or logistics provider